Our Board believes that good governance requires an effective set of specific practices, as well as a culture of responsibility and accountability throughout the organization.

Hologic's board members engage with management, each other and our company's shareholders. In 2015, we implemented a year-round approach to shareholder engagement. In addition to conversations just before our annual meeting, we initiate discussions during a quieter period several months later, reaching out to a number of our largest investors to discuss business highlights, compensation and governance matters — or whatever else is on their minds. Directors participate in these discussions as requested and are updated on calls for which they are not present. Our board takes feedback from investors seriously. Feedback from investors has helped shape our compensation programs, as well as our governance structures.

Board Structure and Composition

A 10-member team brings a mix of experience, diversity and fresh perspectives. Each member is highly engaged and actively contributes to an environment that fosters his or her voice being heard, while supporting and appropriately challenging management. We have an ongoing commitment to board refreshment and to ensure that highly qualified, independent voices sit in our boardroom — which has resulted in an exceptionally well-balanced group.

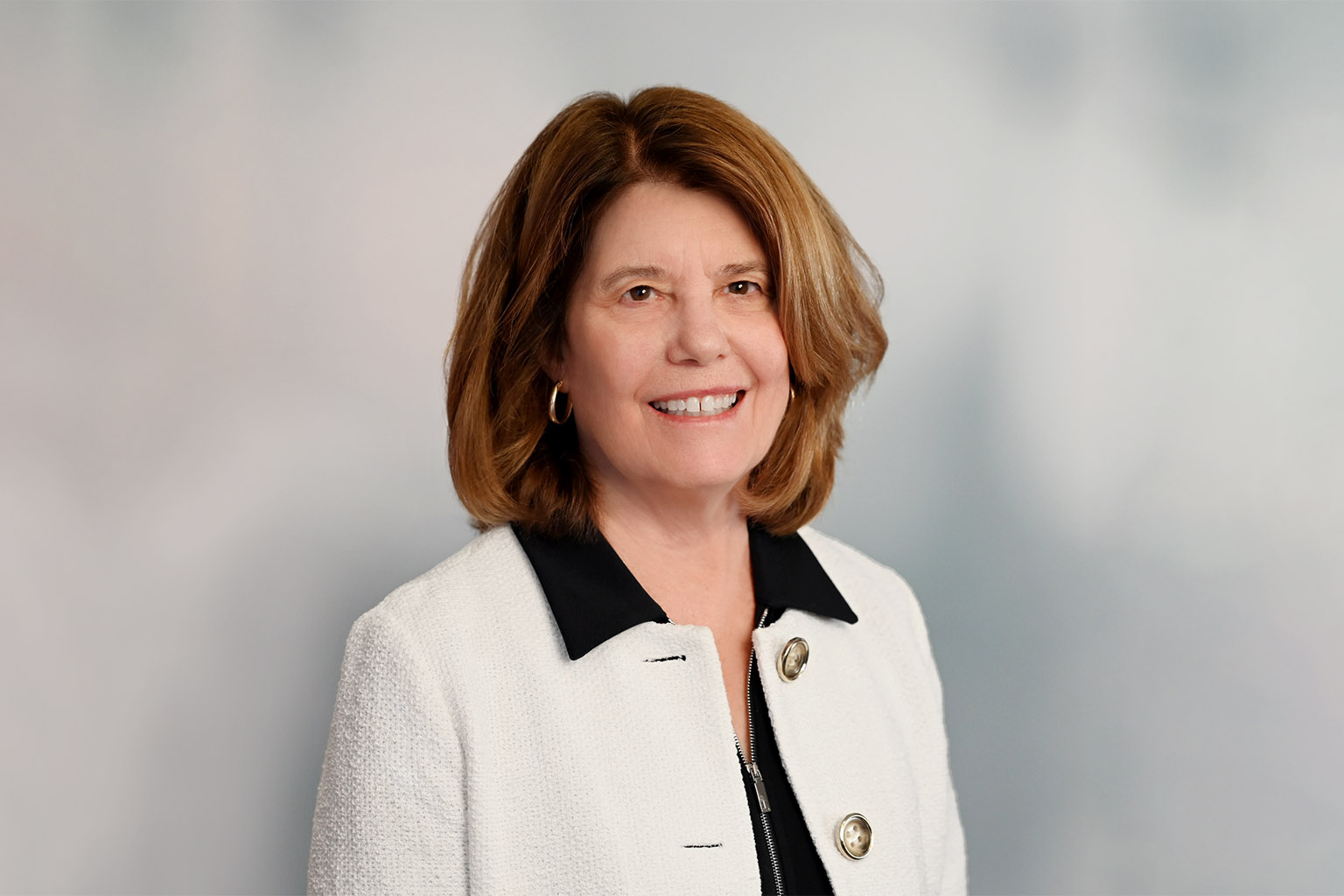

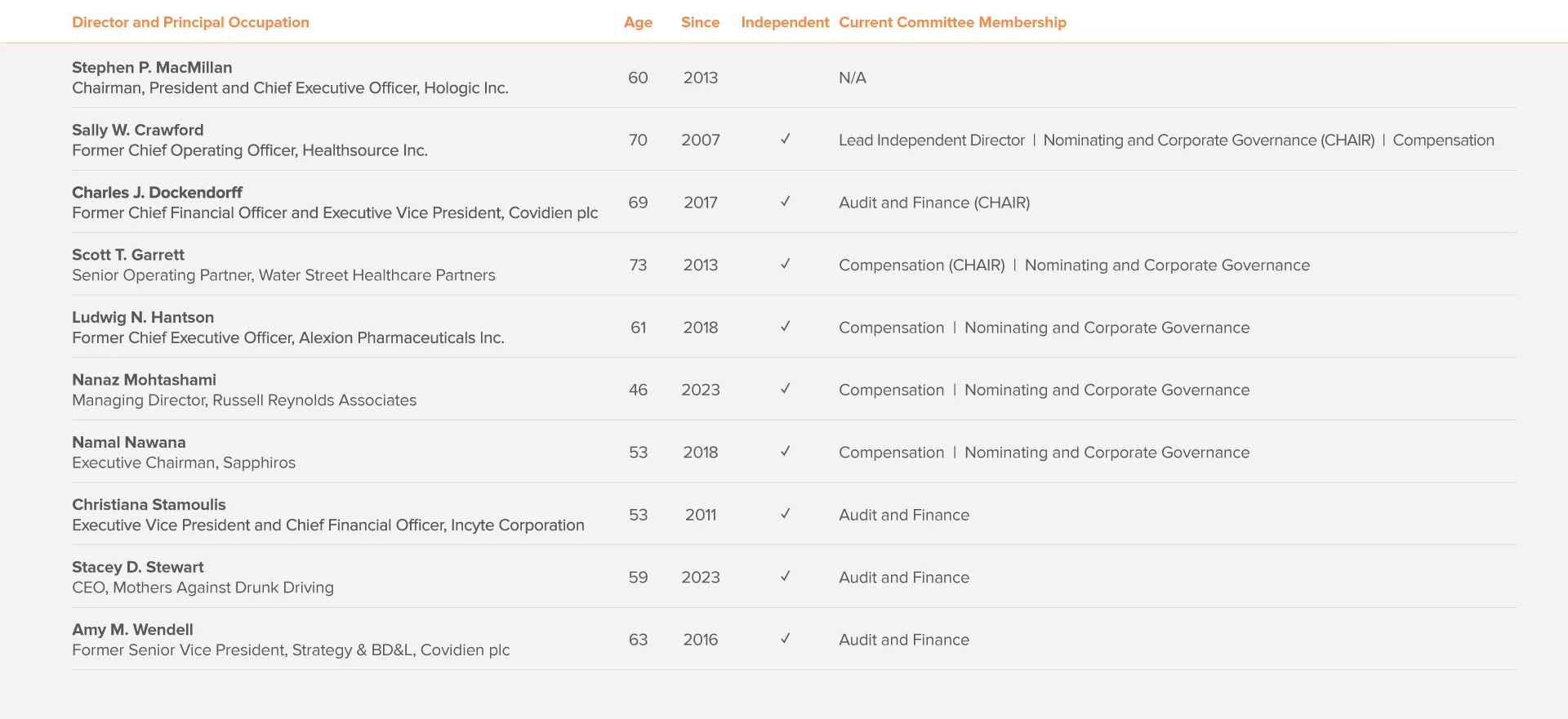

Stephen P. MacMillan

Chairman, President and Chief Executive Officer

Sally W. Crawford

Independent Lead Director, Former Chief Operating Officer, Healthsource Inc.

Charles J. Dockendorff

Former CFO and Executive Vice President, Covidien plc

Scott Garrett

Senior Operating Partner, Water Street Healthcare Partners

Ludwig N. Hantson

Former Chief Executive Officer, Alexion Pharmaceuticals Inc.

Nanaz Mohtashami

Managing Director, Russell Reynolds Associates

Namal Nawana*

Executive Chairman, Sapphiros

Christiana Stamoulis

Executive Vice President and Chief Financial Officer, Incyte Corporation

Stacey D. Stewart

CEO, Mothers Against Drunk Driving

Amy M. Wendell

Former Senior Vice President, Strategy and Business Development, Covidien plc

Photos and bios of our Board members are available on our Investor Relations site.

The Board is composed of a majority of independent directors, and each of the three Board committees (Audit and Finance, Compensation, and Nominating and Corporate Governance) is composed entirely of independent directors. The current membership of our Board and each committee is listed below.

Roles of the Board

The Board assesses risk, evaluates management’s performance, plans for successors and provides overall guidance and direction.

Committee Risk Oversight:

- The Audit and Finance Committee focuses on cybersecurity risk, financial risk and internal controls.

- The Compensation Committee focuses on risks related to compensation.

- The Nominating and Corporate Governance Committee oversees all our governance processes, including Hologic’s reporting and efforts related to sustainability.

Each year, the Board also reviews an enterprise risk management report compiled by business leaders who have assessed risks throughout the organization over a three-year horizon, focusing on financial risk, legal/compliance risk and operational/strategic risk. The report details Hologic’s top 10 risks, as well as mitigating actions and plans relating to those risks.

Board Compensation Philosophy and Structure

The design of our executive compensation program and the decisions made by the Board’s Compensation Committee are guided by these principles:

- Pay for performance.

- Competitive pay.

- A focus on total direct compensation.

Further, Hologic is dedicated to growth, efficient use of capital and shareholder value. Consequently, we use measures of adjusted revenue, adjusted EPS (earnings per share), ROIC (return on invested capital), adjusted free cash flow and relative TSR (total shareholder return) that assure management’s interest to shareholders is structured to drive performance.

Our Board believes that our directors and officers should hold a meaningful financial stake in Hologic to further align their interests with those of our stockholders.

- Each non-employee director is expected to achieve equity ownership in Hologic with a value of five times annual base cash retainer within five years of his or her election to the Board.

- Our CEO is expected to achieve equity ownership in Hologic with a value of five times his then-current base salary.

- Each of our other executive officers is expected to achieve equity ownership in Hologic with a value of two times his or her then current base salary, within five years.

All of our non-employee directors and all of our executive officers who have been subject to these guidelines for over five years have achieved ownership in excess of them.**

Mr. MacMillan owns equity in the company that makes him one of our 25 largest stockholders. He purchased approximately 11% of his shares in the open market. Mr. MacMillan’s interests are well-aligned with those of our stockholders.

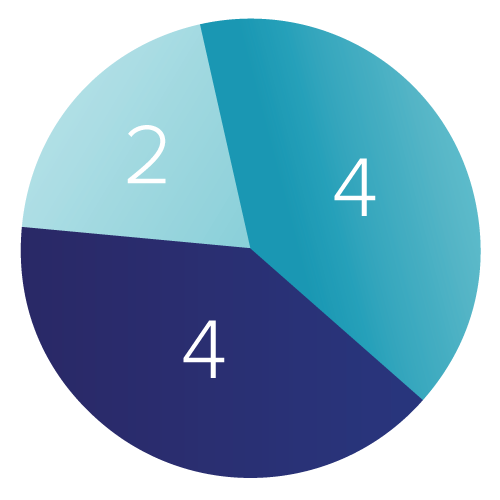

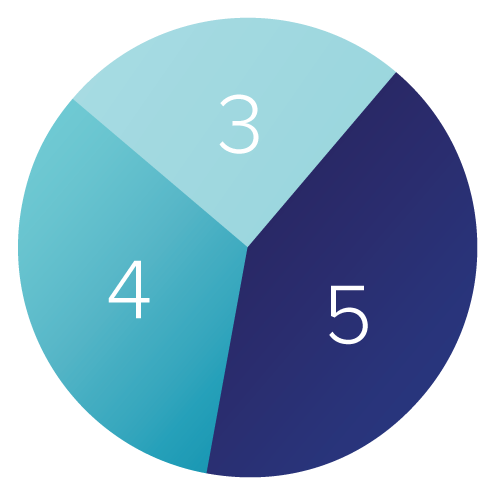

BOARD TENURE DIVERSITY

Average tenure is 7 years

● Newer (≤ 5 yrs.)

● Medium-tenured (6-10 yrs.)

● Experienced (>10 yrs.)

BOARD AGE DIVERSITY

Median age is 61

● 40s

● 50s

● 60s

● 70s

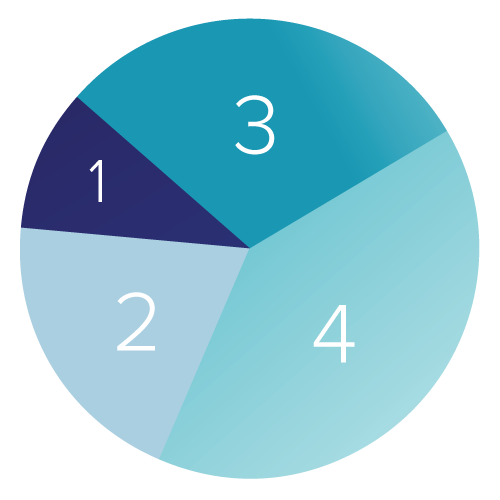

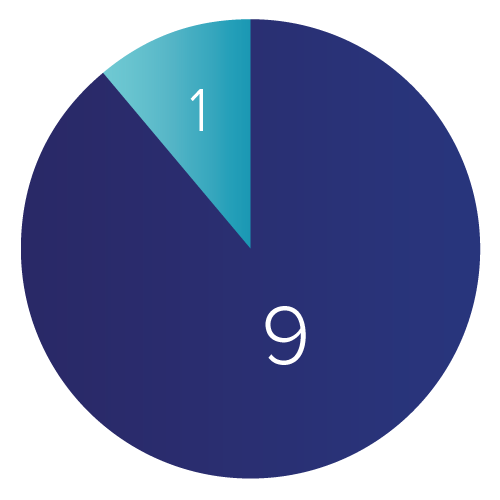

BOARD INDEPENDENCE

Approximately 90% of our Board is independent

● Independent

● Not Independent

BOARD DIVERSITY

Gender, geographic and demographic background diversity

● Female

● Born outside of U.S.

● Underrepresented minority

Individual directors may be included in more than one segment noted above.

* Mr. Nawana has announced his intention to not stand for re-election at the Company’s Annual Meeting on March 7, 2024.

** Only shares of stock issued and outstanding (or vested and deferred under our deferred equity plan) are credited toward the ownership goals. No unvested Restricted Stock Units (RSUs), Performance Stock Units (PSUs) or outstanding stock options (regardless of whether or not vested) are credited toward the ownership goals.